IRS Form 3115: How to Apply Cost Segregation to Existing Properties

What is the Form 3115?

Business owners and tax professionals are often under the impression that cost segregation is not effective for older buildings. Some believe a cost segregation study on an older property will require amending prior tax returns. Others have told us they believed cost segregation could only be applied in the first year of ownership. However, a relatively straightforward tax document called the Form 3115 allows cost segregation to be applied to older buildings without the need for any amended returns.

When a building owner implements a cost segregation study on an existing building, they are changing the depreciation method of their property. The IRS considers this change to be a change in accounting method. The Form 3115 is used to request a change in accounting method from the IRS.

Unless a property owner applies cost segregation the first year a building is placed in service, implementing a study will require filing a Form 3115. The cost segregation study will convert a single-asset with a 39-year or 27.5-year life into several assets with recovery periods ranging from five to 39 years. Moving assets into categories with shorter recovery periods results in larger depreciation deductions. Property with a recovery period of 20 years or less and placed in service after September 27, 2017 may be eligible for bonus depreciation.

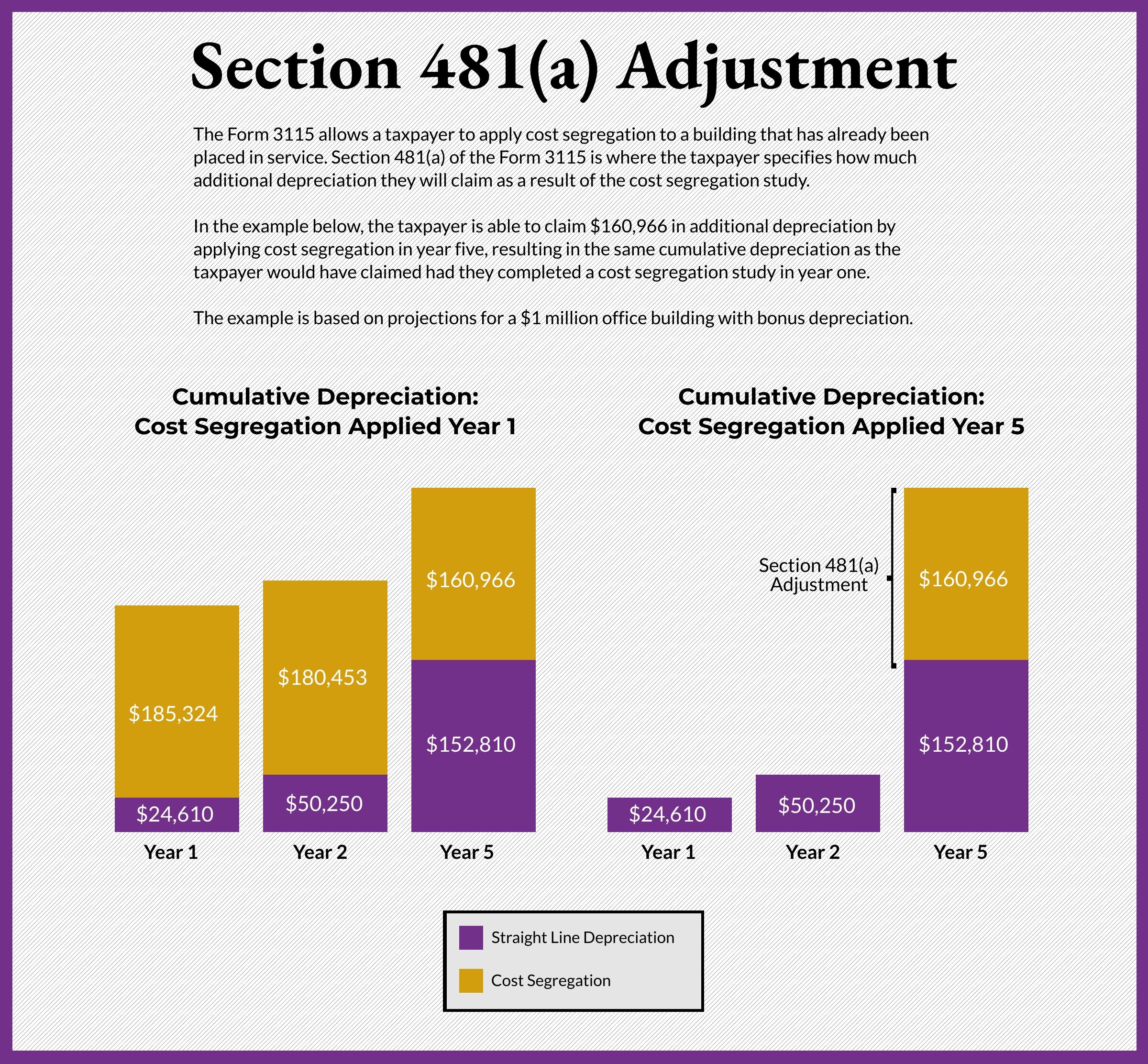

Section 481(a) of the Form 3115 allows a building owner to adjust their income so that they can claim these deductions as if cost segregation had been applied in year one.

Do I need to amend my returns?

One common misconception is that using cost segregation on an older property will require amending prior year tax returns. If this were true, then if a building owner applied cost segregation to a property purchased in 2011, they would have to amend as many as 10 tax returns! Luckily, no amended returns are necessary to reclassify property after a cost segregation study. In fact, the IRS specifies that taxpayers may not implement changes in accounting method by amending prior returns. Instead, the Form 3115 is used.

Certain changes in accounting method—including changes in depreciation—are considered “automatic changes” by the IRS. An automatic change can be filed with no user fee or additional consent from the IRS as long as the change is filed according to IRS guidance. As long as the building owner files the Form 3115 according to the procedures outlined by the IRS, they can take advantage of the tax savings available through cost segregation without additional fees or correspondence with the IRS aside from the Form 3115.

Does a Form 3115 increase my audit risk?

The risk of an audit is minimal as long as the Form 3115 is filed correctly. The IRS notes in its Cost Segregation Audit Techniques Guide that “a taxpayer needs to follow the procedures outlined in the applicable revenue procedure.” An experienced tax professional can help ensure that a taxpayer's Form 3115 filing is compliant with IRS guidelines.

Our accounting partners have experience preparing thousands of Form 3115s specifically for cost segregation studies. We can prepare the Form 3115 for our clients’ tax counsel to review, sign, and file at a reasonable cost. For more information on solutions for the Form 3115 please email our Director of Cost Segregation.

Summary of Form 3115 Impact

Significant tax savings are available to property owners with older buildings. A straightforward process allows building owners to utilize cost segregation on older properties without amending returns. The Form 3115 allows building owners to implement cost segregation studies through an “automatic change” with no additional payment due to the IRS.

Lumpkin Agency provides a complete, hassle-free solution to implementing cost segregation on commercial properties of all shapes and sizes. Not only do we provide engineering-based cost segregation studies, but our team can even prepare the Form 3115 for final approval by our clients’ tax counsel. Request an Estimate through our website to see what your tax savings could be.

This page is intended for general information only, and is not meant to constitute tax advice.